Best Way to measure the ROI of facility improvements: Facility improvements are a significant investment for any business. They can range from simple upgrades like new lighting to more complex projects like HVAC system overhauls or building expansions. But how do you know if your investments are paying off? How can you measure the success of your facility improvements? What metrics should you track to ensure your efforts are delivering real value?

we will guide you through the process of measuring the Return on Investment (ROI) for facility improvements. We’ll explain key concepts, walk you through essential metrics, and provide real-world examples to help you assess whether your upgrades are truly benefiting your business. If you’ve ever wondered how to evaluate the impact of a facility improvement or need a reliable method for calculating ROI, you’re in the right place.

Key Takeaways

- Measuring the ROI of facility improvements helps you understand how much profit your investment has generated.

- Measuring ROI shows how effective your facilities are after improvements, and this improves business costs and productivity.

- Selecting the right Key Performance Indicators (KPIs) is important to measure ROI.

- Measuring ROI helps you understand whether your expenses are in the right direction or not.

Understanding the Importance of Facility ROI

Measuring the ROI of facility improvements is extremely important for businesses. When you make improvements to your facilities—such as installing new technology, increasing energy efficiency or optimizing workspaces—you need to understand how these improvements have contributed to your business performance. Measuring ROI determines whether your investment has achieved business goals, and whether these improvements have proven financially beneficial.

Why Measuring ROI Matters for Your Business

Measuring ROI gives you the opportunity to know what kind of impact your investment has had on your organization’s overall performance. Particularly in the context of facilities improvements, ROI helps ensure that:

- Company resources are being used effectively.

- The cost-benefit balance is right and the improvements made are yielding the most value.

- Decision making becomes more transparent because you can better track the results of improvements.

The Benefits of Optimizing Facility Performance

There are many benefits of optimizing facility performance:

- Cost Reduction – Energy efficiency, improved operational processes, and greater use of resources reduce costs.

- Increased Productivity – A better work environment increases the productivity of employees.

- Marketing and Branding Benefits – Showcasing a nicer and more sustainable facility space has a positive impact on the company’s brand image.

- Improved Efficiency – Optimization of cooling, heating, and other workspaces improves operational efficiency.

Defining ROI for Facility Improvements

When defining the Return on Investment (ROI) for facility improvements, the goal is to measure the financial return or benefits of the investment relative to its cost. ROI helps decision-makers understand whether the expenditure on facility improvements is yielding adequate returns, such as through increased efficiency, savings, enhanced productivity, or improved employee satisfaction.

To calculate and present ROI for facility improvements, you can break down the process into the following steps, often supported with tables to organize the data:

1. Defining the Facility Improvement Costs

This is the total investment made in improving the facility. It can be divided into different cost categories.

| Cost Category | Details | Amount |

|---|---|---|

| Initial Capital Costs | Construction, renovation, equipment purchase | $X |

| Labor Costs | Labor for installation or renovations | $Y |

| Maintenance Costs | Ongoing maintenance after improvement | $Z |

| Training Costs | Staff training for new systems | $W |

| Other Expenses | Any additional costs (e.g., permits) | $V |

| Total Investment | Sum of all cost categories | $X + Y + Z + W + V |

2. Defining the Benefits of Facility Improvements

The benefits are the measurable outcomes that result from the improvements, which could be both tangible (e.g., energy savings) and intangible (e.g., employee morale). Common categories of benefits include:

| Benefit Category | Details | Value |

|---|---|---|

| Energy Efficiency | Savings from reduced energy consumption | $A |

| Maintenance Savings | Reduced costs for repairs or replacements | $B |

| Increased Productivity | Improvement in employee efficiency or output | $C |

| Space Utilization | More efficient use of space leading to cost savings | $D |

| Employee Satisfaction | Benefits from improved working conditions | $E |

| Operational Efficiency | Reduced downtime, faster processes | $F |

| Increased Revenue | Higher customer satisfaction or sales | $G |

| Total Benefits | Sum of all benefit categories | $A + B + C + D + E + F + G |

3. Calculating ROI

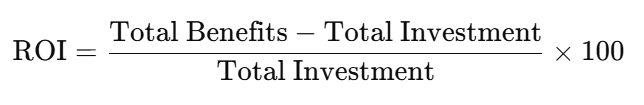

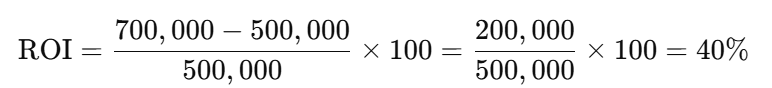

Once you have the total costs and benefits, the ROI formula is:

Example Calculation:

If the total costs for the facility improvement are $500,000, and the total benefits are $700,000, the ROI would be calculated as:

4. Interpreting the Results

The ROI gives you a percentage that helps you assess the effectiveness of the investment:

- ROI > 0%: Indicates a positive return (i.e., the benefits exceed the costs).

- ROI = 0%: Indicates a break-even situation (i.e., the benefits equal the costs).

- ROI < 0%: Indicates a loss (i.e., the costs exceed the benefits).

5. Additional Considerations

- Time Frame: ROI should ideally be calculated over the period when the benefits are expected to be realized (e.g., 1 year, 5 years).

- Qualitative Benefits: Some benefits may be hard to quantify (e.g., employee morale), but can still be important in evaluating the overall success of the investment.

- Risk Adjustment: Consider adjusting the ROI for risks or uncertainty if the improvement could have unforeseen costs or benefits.

Sample Table to Calculate ROI

| Category | Details | Amount ($) |

|---|---|---|

| Initial Costs | Construction, renovation, equipment | 500,000 |

| Maintenance Costs | Ongoing expenses post-improvement | 20,000 |

| Training Costs | For new systems or procedures | 10,000 |

| Total Investment | Sum of costs | 530,000 |

| Energy Savings | Reduced energy consumption | 50,000 |

| Maintenance Savings | Reduced repairs and replacements | 30,000 |

| Productivity Increase | More efficient use of space/employee time | 100,000 |

| Other Benefits | Employee morale, revenue increase | 80,000 |

| Total Benefits | Sum of benefits | 260,000 |

| ROI Calculation | (Total Benefits – Total Investment) / Total Investment x 100 | 260,000 – 530,000 / 530,000 x 100 = -50% |

In this example, the facility improvement results in a negative ROI, indicating that the investment did not produce the expected financial benefits.

Identifying Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) are measurable values that demonstrate how effectively an individual, team, or organization is achieving key business objectives. KPIs are used to track and measure progress toward goals, helping businesses make data-driven decisions.

Here’s an example of identifying KPIs for a Sales Department and displaying them in a table format:

Example 1: KPIs for a Sales Department

| KPI | Description | Formula | Target | Frequency | Current Value | Performance Status |

|---|---|---|---|---|---|---|

| Revenue Growth | Measures the percentage increase in revenue over a period | (Current Revenue – Previous Revenue) / Previous Revenue * 100 | 10% increase | Quarterly | 8% | Off Target |

| Sales Conversion Rate | Percentage of leads converted into sales | (Number of Sales / Number of Leads) * 100 | 25% | Monthly | 22% | Off Target |

| Customer Acquisition Cost (CAC) | Measures the cost of acquiring a new customer | Total Marketing & Sales Expenses / Number of New Customers | $200 | Monthly | $210 | Off Target |

| Average Deal Size | The average revenue generated per deal | Total Revenue / Total Number of Deals | $5,000 | Monthly | $4,800 | Off Target |

| Sales Cycle Length | Average time taken to close a deal | Total Days to Close / Number of Deals | 30 days | Monthly | 35 days | Off Target |

| Lead Response Time | Average time taken to respond to a new lead | Total Time to Respond / Number of Leads | 2 hours | Weekly | 1.5 hours | On Target |

| Customer Retention Rate | Percentage of customers retained over a period | (Customers at End of Period – New Customers) / Customers at Start of Period * 100 | 90% retention | Quarterly | 88% | Off Target |

Breakdown of the KPIs:

- Revenue Growth: Tracks the change in revenue, helping to gauge the financial health of the sales department. A target of 10% indicates that the company is aiming for a significant increase.

- Sales Conversion Rate: Measures how well the sales team is converting leads into customers. A target conversion rate of 25% indicates good performance.

- Customer Acquisition Cost (CAC): Helps measure the efficiency of marketing and sales spend by indicating how much is being spent to acquire each new customer.

- Average Deal Size: Tracks the average revenue generated per sale, providing insights into how large or small deals are in a given period.

- Sales Cycle Length: Indicates how long it typically takes to close a sale, allowing the department to optimize the sales process.

- Lead Response Time: Measures how quickly the sales team responds to new leads. Faster response times are critical for lead conversion.

- Customer Retention Rate: Measures how well the company retains customers, which is crucial for long-term success.

Example 2: KPIs for a Marketing Department

| KPI | Description | Formula | Target | Frequency | Current Value | Performance Status |

|---|---|---|---|---|---|---|

| Website Traffic | Number of visitors to the website | Count of website visits | 50,000 visitors | Monthly | 45,000 | Off Target |

| Lead Generation Rate | Number of leads generated through marketing efforts | Total Leads Generated / Total Website Traffic | 5% | Monthly | 4.5% | Off Target |

| Social Media Engagement | Measures interaction on social platforms | Likes + Shares + Comments / Total Followers | 10% engagement | Monthly | 8% | Off Target |

| Email Open Rate | Percentage of recipients who open marketing emails | (Emails Opened / Emails Sent) * 100 | 20% | Monthly | 18% | Off Target |

| Return on Investment (ROI) | Measures the return from marketing campaigns | (Revenue from Campaign – Cost of Campaign) / Cost of Campaign * 100 | 150% ROI | Campaign-based | 120% | Off Target |

| Customer Lifetime Value (CLTV) | The total revenue a customer is expected to bring | Average Value per Sale * Average Number of Sales per Year | $10,000 | Annually | $8,500 | Off Target |

| Cost per Click (CPC) | The cost of each click in a paid advertising campaign | Total Ad Spend / Total Clicks | $2 per click | Weekly | $2.50 | Off Target |

Explanation of Marketing KPIs:

- Website Traffic: Tracks the overall number of visitors to the website, indicating the success of marketing efforts in driving awareness.

- Lead Generation Rate: Measures the effectiveness of the website in converting traffic into potential customers.

- Social Media Engagement: Measures how well the brand is interacting with its social media audience, showing the impact of social media strategies.

- Email Open Rate: Indicates the effectiveness of email marketing campaigns in capturing the attention of recipients.

- Return on Investment (ROI): Measures the profitability of marketing campaigns and helps in evaluating campaign success.

- Customer Lifetime Value (CLTV): Calculates the total expected revenue from a customer, helping marketers identify high-value customers.

- Cost per Click (CPC): Measures the cost-efficiency of paid advertising campaigns, ensuring marketing budgets are well spent.

These tables help to identify the most critical KPIs for tracking and improving the performance of specific departments. The target and current value columns allow comparison, and the performance status column highlights areas where attention may be needed.

Calculating the Costs of Facility Improvements

Calculating the Costs of Facility Improvements” involves estimating the financial investment required to upgrade or enhance a building or facility. This process includes assessing direct costs like materials, labor, and equipment, as well as indirect costs such as permits, taxes, and potential disruptions to business operations.

Accurate cost calculation helps ensure the project stays within budget, meets desired quality standards, and minimizes unexpected expenses. It may also consider long-term costs like maintenance and energy efficiency improvements, providing a comprehensive view of the investment required for successful facility upgrades

FAQ

How long does it take to see ROI from facility improvements?

The time it takes to see ROI depends on the nature of the improvement. For example, energy-saving upgrades may show immediate cost reductions, while changes that improve customer experience may take several months to reflect in sales data.

Can ROI be measured without financial data?

While financial metrics are the most direct way to calculate ROI, non-financial benefits such as employee satisfaction, safety, or customer loyalty can also play a significant role in determining overall ROI. These can be tracked using surveys, feedback, and other qualitative data.

What’s the best way to track long-term ROI?

For long-term ROI, it’s crucial to monitor the benefits over an extended period. This includes regular tracking of costs and savings, as well as performance metrics like productivity, energy usage, and customer retention. Setting up automated systems for data collection can help maintain accuracy over time.

Amazing information😘

well done good work

very informative